TRAVERSE Global v11.1

Intercompany Accounts

Use the Intercompany Accounts function to define how the system processes intercompany account transfers. This function is available only if you have the Not for Profit add-on installed.

Intercompany accounts are used to automatically create the necessary entries when multiple companies use TRAVERSE. Often, one company incurs expenses that belong to another company (in the case of holding companies, for example). For correct accounting, these expenses need to be removed from the company that incurred them and transferred to the correct company for which they were incurred. When you set up intercompany accounts, you ensure that journal entries are transferred from and to the appropriate companies automatically, eliminating manual entries.

Before you can transfer expenses between companies, you must make sure the companies satisfy these requirements:

- The companies must use the same segment definitions.

- The companies must use the same GL account numbers, at least for the accounts between which expenses are transferred.

- The companies must use the same base currency.

If you select the Use Intercompany Accounts check box in the Business Rules function, journal entries are transferred between companies according to the accounts you set up here when you post transactions. When this option is selected, the Post to Master function automatically reverses journal entries for the current company and creates offsetting journal entries in the transfer account you specify in this function to balance the journal. The system then performs this processing in reverse for the company to which to transfer the entries.

- Select a segment type from which to transfer entries from the Segment Type field. Each selection will change the label on the segment value column to match the type. For example, if you select a segment type of Department, the label for the segment value column will be Transfer DEP.

- Select a segment value for your Transfer DV/DEP/Main/Account, from which to transfer transactions.

- Select the company to which you want to transfer journal entries in the Company field.

- Select the account in the source company to debit during processing from the Due from Account ID field.

Note: The account you select must match currencies with the account selected in the Due to Account ID field in step 5. - Select the account in the destination company to credit during processing from the Due to Account ID field.

Note: The account you select must match currencies with the account selected in the Due from Account ID field in step 4. - Click the Save button, on the toolbar, to save the new intercompany account.

- Select a segment type to edit from the Segment Type field.

- Edit the fields as necessary.

- Click the Save button, on the toolbar, to save any changes made to the intercompany accounts.

- Select a segment type from the Segment Type field.

- Select a segment value to delete from the Transfer DVfield.

- Click the Delete button, on the toolbar, to delete the selected segment type.

- Click Yes at the "Are you sure you want to delete selected record(s)?" prompt.

Entries are transferred between companies according to the accounts you set up here when you post if you select the Use Intercompany Accounts check box in the Business Rules function.

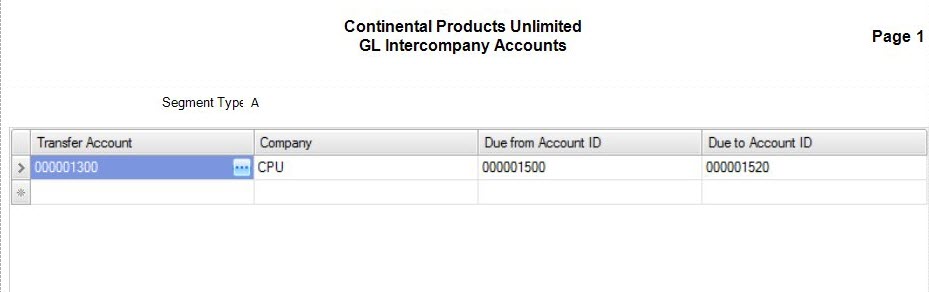

Below is an example of what happens when you use the Intercompany Accounts function.

Selected A for the Segment Type.

| Transfer Account: | 00-000-1300 | |

| Account Debit: | 00-000-1500 | |

| Account Credit: | 00-000-1520 |

Original transaction entries:

| Account ID | Debit | Credit |

| 00-000-1300 | 50.00 | 0.00 |

| 00-000-2000 | 0.00 | 50.00 |

Entries after post in from company (CPU):

| Account ID | Debit | Credit | Notes |

| 00-000-1300 | 50.00 | 0.00 | From original entries |

| 00-000-2000 | 0.00 | 50.00 | From original entries |

| 00-000-1300 | 0.00 | 50.00 | Offset to debit from original entries |

| 00-000-1500 | 50.00 | 0.00 | Offset to credit from original entries |

Entries after post in to company (CPC):

| Account ID | Debit | Credit | Notes |

| 00-000-1300 | 50.00 | 0.00 | From original entries in from company (CPU) |

| 00-000-1520 | 0.00 | 50.00 | Offset to debit from source company (CPU) |

Print the Intercompany Accounts List to view and verify the intercompany accounts you set up.

- Select the print preview button (

) to preview the list. This is only applicable in the Filter view.

) to preview the list. This is only applicable in the Filter view. - The preview report screen appears.

- Select the print button (

) in the toolbar to print your list.

) in the toolbar to print your list.