Traverse Standard v11.0

Post Transactions

When you post transactions, these things happen in the Bank Reconciliation system:

- The transactions in the BR Journal are moved to the BR Master.

- If Bank Reconciliation does not interface with General Ledger, the general ledger account balance stored in the Bank Currency Balance field on the Balance tab is updated.

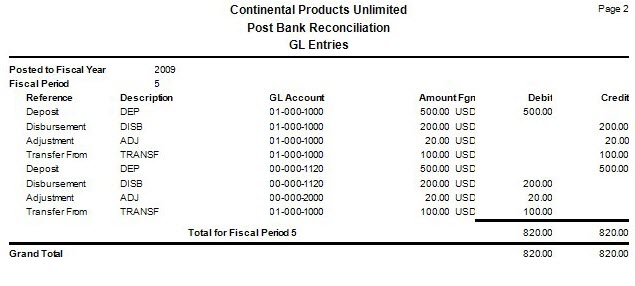

- If Bank Reconciliation interfaces with General Ledger, entries are created in the GL Journal for the bank account entries and offsetting entries that you entered for deposit, disbursement, adjustment, transfer, and void check transactions. If the accounting period is closed, you can either edit the transactions or use the System Manager Period Conversion function to open the accounting period and then post the transactions.

When you post deposits, entries are made to these accounts:

| Account | Entry |

| Bank Account | Debit |

| Offsetting Account(s) | Credit |

| Additional Offsetting Accounts | Debit/Credit |

The bank account's GL account comes from the bank account record. You specified the offsetting GL accounts when you entered deposits. If the deposit was offset by only one account, the offsetting account is credited. If the deposit was offset by several accounts, there might be a combination of debit and credit entries to offsetting accounts.

If you entered a reversing deposit (you entered a negative amount in the deposit transaction), the bank account is credited and the offsetting account is debited. If the deposit was offset by more than one account, there might be a combination of debit and credit entries to the offsetting accounts.

When you post disbursements, entries are made to these accounts:

| Account | Entry |

| Bank Account | Credit |

| Offsetting Account(s) | Debit |

The bank account's GL account comes from the bank account record. You specified offsetting accounts when you entered the disbursements. If the disbursement was offset by only one account, the offsetting account is debited. If the disbursement was offset by several accounts, there might be a combination of debit and credit entries to offsetting accounts.

If you entered a reversing disbursement (you entered a negative amount in the disbursement transaction), the bank account is debited and the offsetting account is credited. If the disbursement was offset by more than one account, there might be a combination of debit and credit entries to the offsetting accounts.

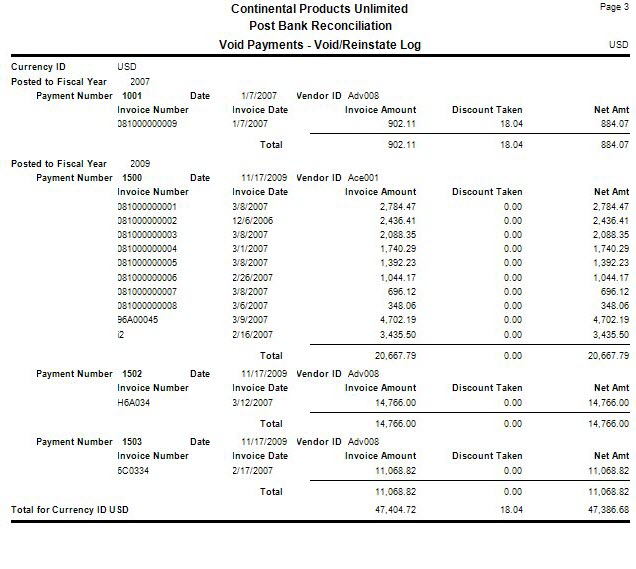

When you post voided BR checks, entries are made to these accounts:

| Account | Entry |

| Bank Account | Debit |

| Offsetting Account | Credit |

| Additional Offsetting Account | Debit/Credit |

The bank account's GL account is from the bank account record. You specified offsetting accounts when you voided the checks. If the voided check was offset by only one account, the offsetting account is credited. If the voided check was offset by several accounts, there might be a combination of debit and credit entries to offsetting accounts.

If you voided a negative check, the bank account is credited and the offsetting account is debited. If the voided check is offset by more than one account, there might be a combination of debit and credit entries to the offsetting accounts.

When you post voided Accounts Payable checks, entries are made to these accounts:

| Account | Entry |

| Bank Account | Debit |

| Discounts | Debit |

| AP | Credit |

The bank account's GL account is from the bank account record. The discount account is from the AP application's Business Rules. AP accounts are specified from the distribution code.

When you post voided Payroll checks, entries are made to these accounts:

| Account | Entry |

| Earning Code Expense Account | Credit |

| Cash | Debit |

| Employee Federal, State, and Local Withholding Liability Account | Debit |

| Employer Federal, State, and Local Withholding Liability Account | Debit |

| Employee Liability Account | Debit |

| Employer Withholding Expense Account | Credit |

| Employer Cost Liability Account | Debit |

| Employer Cost Expense Account | Credit |

The bank account’s GL account is from the bank account record. The tax accounts come from the liability account set up for the corresponding tax. The earnings expense, employer cost expense and tax expense accounts come from the department setup.

When you post positive adjustments, entries are made to these accounts:

| Account | Entry |

| Bank Account | Debit |

| Offsetting Account | Credit |

| Additional Offsetting Accounts | Debit/Credit |

The bank account's GL account is from the bank account record. You entered the offsetting GL accounts when you entered the adjustments. If the positive adjustment was offset by only one account, the offsetting account is credited. If the adjustment was offset by several accounts, there might be a combination of debit and credit entries to offsetting accounts.

When you post negative adjustments, entries are made to these accounts:

| Account | Entry |

| Bank Account | Credit |

| Offsetting Account | Debit |

| Additional Offsetting Accounts | Debit/Credit |

The bank account's GL account is from the bank account record. You specified the offsetting GL accounts when you entered the adjustment. If the negative adjustment was offset by only one account, the offsetting account is debited. If the adjustment was offset by several accounts, there might be a combination of debit and credit entries to offsetting accounts.

When you post transfers, entries are made to these accounts:

| Account | Entry |

| From Bank Account | Credit |

| To (Offsetting) Bank Account | Debit |

| Additional Offsetting Accounts | Debit/Credit |

The bank accounts' GL accounts come from the bank account record. If the amount was transferred to only one bank account, the bank account is debited. If the amount was transferred to several bank accounts, there might be a combination of debit and credit entries transferred to the bank accounts.

If you entered a reversing transfer (a negative amount entered in the transfer from account), the bank account is debited and the transferred-to bank account is credited. If the amount is transferred from more than one bank account, there might be a combination of debit and credit entries transferred to bank accounts.

- Complete transaction entry.

- Print the Bank Reconciliation Journal.

- Select the Do the following then check the box check box.

-

If you use multicurrency, select the Print Log Using Base Currency check box to print the log using your base, or functional, currency. When this check box is clear, the log includes posted values organized by currency along with their base currency equivalents.

- Select the bank accounts to post for which you want to post transactions.

- Enter comments for the post, if applicable, in the Comments field.

- Click a command button to

| Click | To |

| OK | Begin posting the transactions. |

| Activity | Display the Activity Log to view posting activity. |

| Reset | Set all fields to their default values. |