Traverse Standard v11.0

941 Worksheet

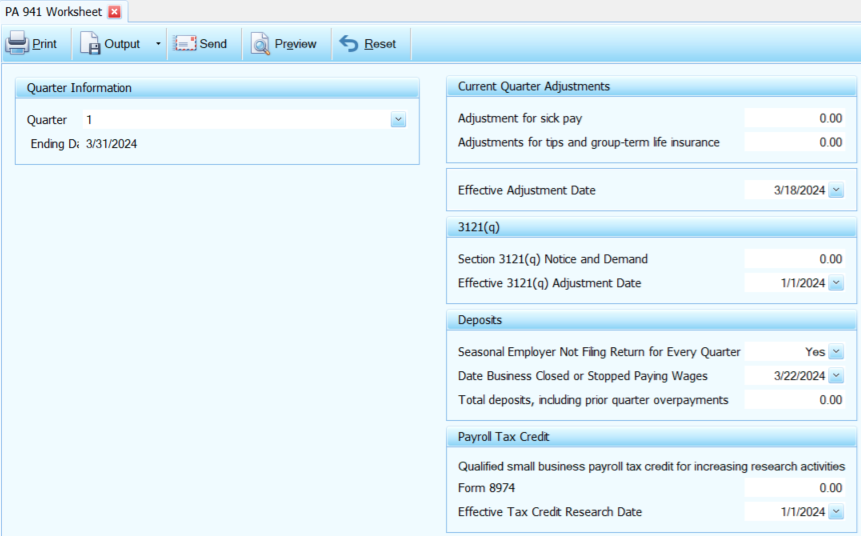

The 941 Worksheet function allows you to print a 941 worksheet showing your company's record of federal tax liability for the quarter you specify. The 941 worksheet generated by Traverse is not meant to be filed with the federal government. Use it only as a reference to complete and file the government-produced form.

NOTE: You must gather the required information to enter into the worksheet tool in accordance with the Form 941 instructions. Make sure you double-check your information; the system does not validate numbers you enter into any prompts. Refer to the Form 941 instructions or consult a tax professional with any questions.

941 Worksheet

- Select the quarter for which you want to print the worksheet from the Quarter field.

- In the Current Quarter Adjustments section:

- Enter the adjustment for the employee share of OASDI taxes that were withheld by your third-party sick pay payer for the current quarter in the Adjustment for sick payfield.

- Enter the current quarter Adjustment for tips and group-term life insurance for any uncollected employee share of OASDI and Medicare taxes on tips and group-term life insurance premiums paid for former employees for the current quarter in the next field.

- Select the month and date the adjustments should take effect, or the date you realized the adjustments were necessary, for the Effective Adjustment Date.

- In the 3121(q) section:

- Enter the Section 3121(q) Notice and Demand—Tax due on unreported tips, for the amount of Social Security taxes on unreported tips shown on the Section 3121(q) Notice and Demand on the Employer's Form 941 for the calendar quarter corresponding to the 'Date of Notice and Demand.'

- Enter the Effective 3121(q) Adjustment Date to show the month and date the adjustments should take effect, or the date you realized the adjustments were necessary.

- In the Deposits section:

- If you are a Seasonal Employer Not Filing Return for Every Quarter, select 'Yes'. This field is required.

- As applicable, enter or select the Date Business Closed or Stopped Paying Wages.

- Enter the Total deposits, including prior quarter overpayments.

- In the Payroll Tax Credit section:

- Enter the Qualified small business payroll tax credit for increasing research activities amount into the field. Enter the amount of the credit from Form 8974.

- Select the month and date the adjustments should take effect, or the date you realized the Tax Credit was effective, for the Effective Tax Credit Research Date.

- Click a command button to

| Select | To |

| Print the 941 Worksheet using the selected criteria. | |

| Output | Output the worksheet as a PDF. |

| Send | Save the worksheet as a PDF and attach it to an email using your default mail program. |

| Preview | Preview the 941 Worksheet using the selected criteria. |

| Reset | Reset all fields and lists to their default selections. |