Traverse Global v11.2 - Service Repair

Post Cash Receipts

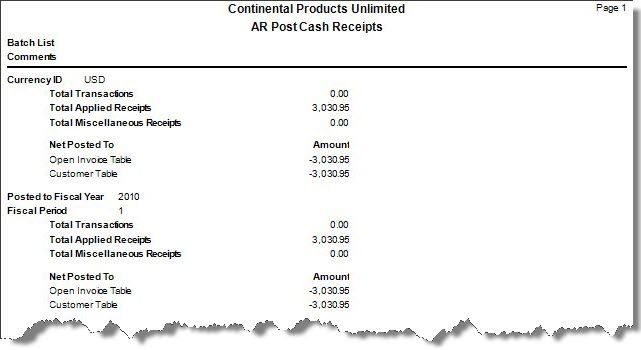

When you post cash receipts, a payment record is created for each cash receipt. Each cash receipt transaction is applied to the invoice indicated from the cash receipt transaction record.

The system creates temporary tables to store cash receipts information as information is posted and totals are updated. When all cash receipt information is posted, summary GL entries are calculated.

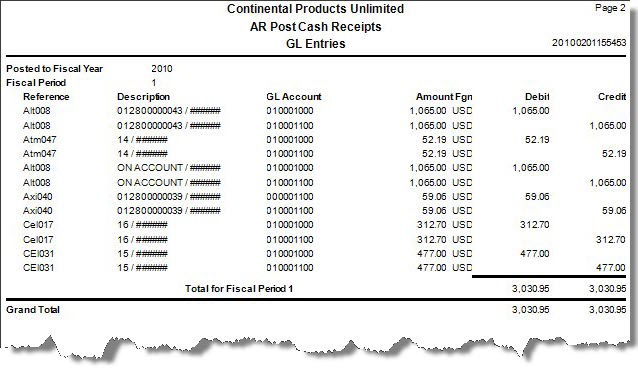

If Accounts Receivable interfaces with General Ledger, debit and credit entries are created in the GL Journal. If detail information is posted, entries are made for each cash receipt entry. If summary information is posted, one entry is made for each account. If the accounting period is closed, you can either edit cash receipts or use the System Manager Period Conversion function to open the accounting period and then post the cash receipts.

Posting cash receipts also updates balance and payment history fields in the customers’ records.

If you use multicurrency, Traverse automatically creates entries for any realized gains or losses due to fluctuating currency exchange rates for payments in the accounts you specified in the System Manager Gains and Losses Accounts function when you post to record those gains and losses for correct accounting. Because individual transactions may have been recorded with different exchange rates, information is always posted in detail when you use multicurrency.

When you post invoices for cash receipts, entries are made to these accounts:

| Account | Entry |

| AR | Credit |

| Cash | Debit |

| Discounts | Debit |

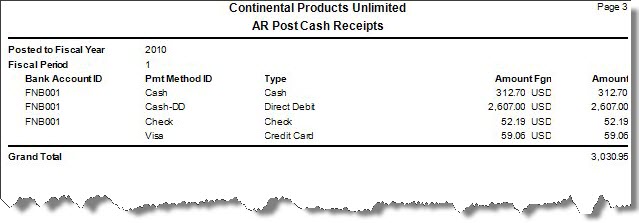

The payment method record determines the cash account, and the default GL account set up in the Business Rules function determines the discounts account.

The source of the accounts receivable account (or whichever account is credited by cash receipts) can vary. If you enter a customer ID when you enter cash receipts, the associated distribution code specifies the accounts receivable account. If you do not enter a customer ID when you enter cash receipts, you specify the credited account.

Use the Periodic Maintenance function to update or delete completed transactions.

Before you post, complete the following tasks:

- Complete cash receipts entry and print journals and invoices.

- If you have a multi-user system and are not using batch processing, verify no one else is using the cash receipts function.

- Print the Cash Receipts Journal.

Use the Post Cash Receipts function to post cash receipt transactions. The Cash Receipts function provides information for the Cash Receipts Journal. Print the Cash Receipts Journal before you post cash receipts for the day to check for errors and omissions. If you find errors in the Cash Receipts Journal, use the Cash Receipts function to correct them before posting. Posted entries are cleared from this function to make room for the next group of entries.

To Post Cash Receipts, follow these steps:

- Complete AR Transaction entry.

- Print invoices.

Note: Invoices cannot be reconstructed after they have been posted. - Print the Cash Receipts Journal.

Note: The Cash Receipts function provides information for the Cash Receipts Journal. Posted entries are cleared from these functions to make room for the next group of entries. - Select the Do the following then check the box check box.

- Select the batches to post.

Note: This option only appears if you elected to use batch processing in the Business Rules function. You can use the All button to select all batches to post or you can use the None button to deselect all batches from posting. - Enter comments for the post, if applicable, in the Comments field.

- Click a command button to

| Click | To |

| OK | Begin posting. |

| Activity | Display the Activity Log to view posting activity. |

| Reset | Set all fields to their default values. |